Featured

Table of Contents

Financial stress has actually ended up being a specifying quality of modern-day American life. With total charge card financial obligation surpassing $1.21 trillion and the ordinary cardholder owing more than $6,500, numerous people discover themselves entraped in cycles of minimum settlements and intensifying rate of interest. When credit score card rates of interest hover around 23%, even small balances can balloon into frustrating worries within months.

For those drowning in financial debt, the concern isn't whether to look for assistance-- it's finding the appropriate type of assistance that won't make matters worse.

The Expanding Demand for Debt Forgiveness Solutions

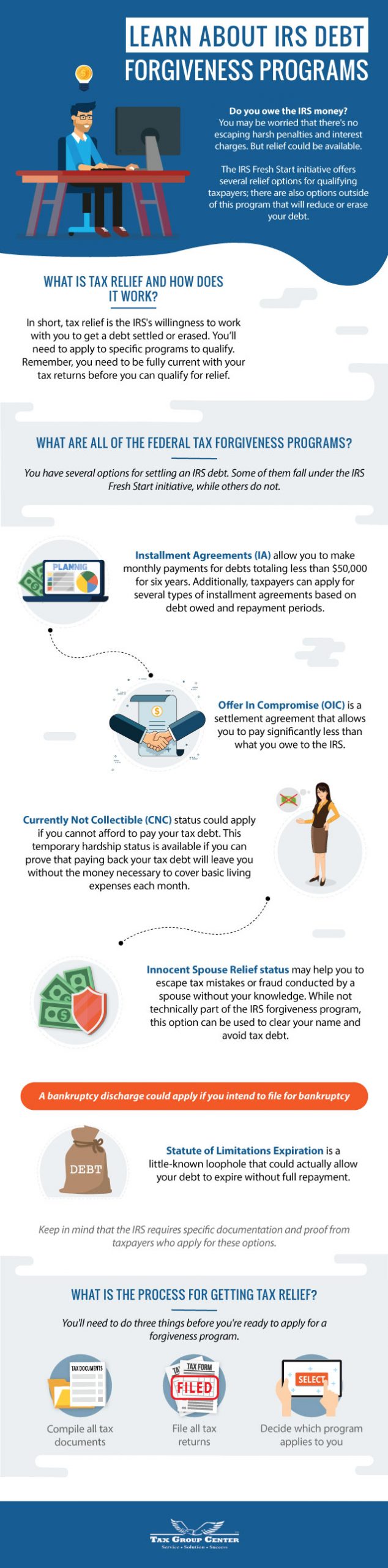

Financial obligation forgiveness has arised as among one of the most browsed financial topics online, and completely factor. The principle of working out financial obligations for much less than the total owed deals real wish to individuals who see no practical course to paying their equilibriums in full.

The procedure typically functions like this: when bank card accounts go overdue for 120 days or more, financial institutions typically bill off the financial debt. At this phase, they might accept minimized settlements to recoup at the very least a portion of what's owed. Successful arrangements can reduce equilibriums by 30% to 50%, depending on the creditor and your demonstrated financial hardship.

Nevertheless, financial obligation forgiveness isn't complimentary cash. Cleared up accounts appear on credit rating reports as "" paid less than complete equilibrium,"" which affects your score. Furthermore, forgiven amounts exceeding $600 might be reported to the internal revenue service as gross income. Understanding these compromises prior to going after settlement is necessary.

Insolvency Counseling: The Misunderstood Safeguard

Bankruptcy brings significant stigma, yet it continues to be a legitimate lawful tool designed to offer overloaded people a real new beginning. What lots of individuals don't realise is that government legislation needs 2 therapy sessions prior to and after filing-- and these sessions exist particularly to guarantee you're making an informed choice.

Pre-bankruptcy credit history therapy includes an extensive testimonial of your earnings, debts, and expenses. Licensed counselors existing options you may not have considered, consisting of financial obligation management programs or difficulty settlements. This isn't about dissuading insolvency; it's concerning validating it's really your finest alternative.

Post-bankruptcy debtor education and learning prepares you for monetary success after discharge. You'll discover budgeting techniques, conserving methods, and credit score rebuilding approaches designed to stop future financial difficulties.

Organisations like APFSC deal both required training courses, with charges around $19.99 per session unless you get approved for difficulty waivers. Their accredited therapists give same-day certifications, and sessions commonly run 60 to 90 mins. This access matters when you're already emphasized regarding funds.

Comparing Your Debt Relief Options

Understanding the landscape of debt alleviation helps you make informed decisions. Each approach brings distinct benefits and downsides.

Debt Administration Programs settle several unsafe financial debts into single month-to-month repayments. Therapists discuss with lenders to possibly lower rates of interest without calling for brand-new finances. Many customers complete these programs within 3 to five years. The primary advantage is paying financial obligations in complete while reducing complete passion paid.

Financial debt Settlement discusses lowered benefit amounts, generally 30% to 50% less than owed. This technique requires stopping payments to lenders while collecting negotiation funds, which harms credit score ratings during the process. Outcomes vary based upon creditor desire and your demonstrated hardship.

Personal bankruptcy offers court protection while removing or reorganizing financial debts. Chapter 7 liquidates certain assets to discharge unsecured financial debts quickly. Phase 13 establishes three-to-five-year repayment plans for those with regular revenue. Bankruptcy remains on credit rating reports for seven to ten years yet provides one of the most comprehensive fresh beginning.

Debt Counseling supplies education and guidance without always enlisting in official programs. Licensed counselors review your complete monetary photo and suggest ideal following steps, which may include any one of the above choices.

What Establishes Nonprofit Therapy Apart

The distinction between not-for-profit and for-profit financial obligation alleviation firms matters immensely. Nonprofit agencies like those certified by the National Structure for Debt Therapy (NFCC) operate under rigorous honest guidelines and cost laws. Their therapists undertake rigorous certification and must recertify every two years.

For-profit debt settlement business, on the other hand, may charge fees varying from 15% to 25% of registered debt balances. Some use hostile sales tactics and make unrealistic assurances about results. The Consumer Financial Defense Bureau has documented numerous issues concerning aggressive practices in this sector.

APFSC operates as a nonprofit counseling company, offering totally free financial obligation management examinations and regulated charges for ongoing services. Their HUD-approved housing counselors include worth for those encountering repossession together with basic financial debt issues. Providers are available in English, Spanish, and Portuguese, increasing ease of access to underserved areas.

Study sustains the performance of not-for-profit therapy. A research study commissioned by the NFCC located that credit therapy clients lowered revolving financial obligation by $3,600 more than contrast groups throughout the 18 months following their sessions. Nearly 70% of individuals reported enhanced cash management and higher economic self-confidence.

Caution Indications of Predative Financial Debt Alleviation Solutions

Not all financial debt alleviation business have your benefits at heart. Recognising red flags protects you from making a difficult circumstance worse.

Be mindful of companies that guarantee certain outcomes. No genuine service can promise exact negotiation percentages or timeline assurances because results depend on individual financial institutions and situations.

Stay clear of any kind of business demanding huge in advance fees prior to providing solutions. Legit not-for-profit therapy offers totally free first assessments, and for-profit negotiation business are lawfully restricted from gathering costs till they successfully resolve at the very least one financial obligation.

Inquiry anyone advising you to quit interacting with creditors completely without clarifying the effects. While strategic interaction stops in some cases support settlements, total evasion can result in suits, wage garnishment, and extra damages.

Legitimate agencies explain all options honestly, consisting of alternatives that could not entail their paid solutions. If a firm pushes just one remedy no matter your scenario, look for assistance elsewhere.

Taking the Initial Step Toward Recovery

Financial recuperation begins with truthful analysis. Collect your newest statements for all financial debts, compute your total responsibilities, and review your sensible month-to-month settlement capability. This information develops the structure for any type of efficient counseling session.

Think about scheduling cost-free assessments with multiple not-for-profit firms prior to dedicating to any kind of program. Contrast their recommendations, charge structures, and communication designs. The best counseling partnership ought to really feel encouraging as opposed to pressuring.

Organisations like APFSC use online conversation, phone assessments, and comprehensive consumption procedures developed to understand your unique situation before suggesting options. Their financial obligation administration calculator aids you visualise prospective timelines and cost savings before enlisting.

The Path Onward

Overwhelming debt does not define your future-- however neglecting it will. Whether financial obligation mercy, insolvency counseling, or structured financial debt management makes good sense for your scenario depends on factors special to your situations.

Professional guidance from certified nonprofit therapists lights up options you may never ever find individually. These services exist specifically to aid people like you navigate complicated economic difficulties without predacious charges or impractical guarantees.

The average American having problem with financial obligation waits far also long prior to seeking assistance, enabling interest to substance and alternatives to narrow. Monthly of hold-up costs money and prolongs your recovery timeline.

Online vs Phone Credit Counseling: Which Format Is Right for You?Your very first discussion with a certified therapist costs absolutely nothing yet could transform everything. Financial freedom isn't reserved for the fortunate-- it's readily available to anyone prepared to take that initial step toward recognizing their choices and committing to a practical plan.

Table of Contents

Latest Posts

The 8-Second Trick For Actual Testimonials from Bankruptcy Counseling Clients

More About What Legislation Guarantees While Receiving Debt Relief

How Everything to Understand During the Debt Forgiveness Process can Save You Time, Stress, and Money.

More

Latest Posts

The 8-Second Trick For Actual Testimonials from Bankruptcy Counseling Clients

More About What Legislation Guarantees While Receiving Debt Relief

How Everything to Understand During the Debt Forgiveness Process can Save You Time, Stress, and Money.